AI for health care is all the rage. Who wouldn’t be excited about applications that could help detect cancer, diagnose COVID-19 or even dementia well before they are otherwise noticeable, or predict diabetes before its onset? Machine and deep learning have already been shown to make these outcomes possible.

Possible, that is, in the research lab. In health care, there is often a long lag between research findings and implementation at the bedside. In order for AI-driven advancements to become a clinical reality, they have to be submitted to and approved by the Food and Drug Administration (or similar regulatory authorities outside the United States) as “AI/machine learning-based software as a medical device.” Several hundred such applications have already been approved. But those tools then have to be accepted by clinicians, merged into their clinical workflows, integrated into electronic health records and other systems, and reimbursed by health insurers.

Few clinical AI systems have successfully run this entire gantlet. And until clinical AI systems result in significant productivity advances, the economic value from them is in doubt. Thus far, for example, we’re confident that they haven’t replaced a single human clinician.

Contrast that situation with the current potential for administrative AI systems in health care. These use cases don’t have to be approved by the FDA, or even by insurance companies (indeed, they are used in many cases to reduce friction with payers). They don’t have to be accepted by physicians, for the most part. And while they do have to be integrated with administrative workflows and systems, cloud- and API-based AI systems make the process much easier.

In terms of economic value, the case for administrative AI is also much clearer. Administrative costs in the U.S. averaged $2,497 per capita in 2017 — 34% of total health care costs. Health care economists in the U.S. often argue that reducing administrative costs is one of the most feasible ways to cut overall costs for health care. For example, David Cutler, a Harvard economist who was one of the architects of the U.S. Affordable Care Act (“Obamacare”) system, has proposed a series of changes to administrative processes that he argues could save $50 billion in costs and “result in greater satisfaction for both patients and providers.” Some of these proposals involve automation and AI, such as an automated claims clearinghouse and automated prior-authorization processes. The potential here is significant.

Opportunities for Revenue Cycle AI

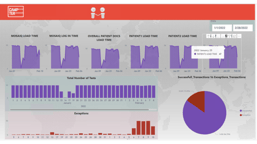

Foremost among the opportunities for administrative AI is the revenue cycle area — authorization, billing, and payments. This is a contentious and labor-intensive area for many health care providers and payers. Several insurance companies, including Anthem, United Healthcare’s Optum, and Florida Blue, are automating the prior-authorization process using AI. One study estimated that manual prior authorizations can take up to 16 hours per week for physicians.

Coding medical treatments for reimbursement and record-keeping is a challenging task for humans, with over 55,000 different codes in the latest version of the International Classification of Diseases. Several companies have already implemented coding assistance AI systems that translate clinical notes into codes, but for now they still require review by human coders.

Another challenge for humans in the revenue cycle is the estimation of medical bills before treatment. Complex billing and payment arrangements make estimation difficult, but patients are more likely to pay medical bills when they have accurate estimates, and the U.S. government now requires them — although many providers are not compliant. Baylor Scott & White Health’s system, however, has used a machine learning-based system to create accurate estimates based on past billing data. About 70% of its estimates are created without human intervention, and the estimates have led to a 60% to 100% improvement in point-of-service collections.

Providers and payers also engage in a lot of back-and-forth about payments and when they will be made. This is another great area for the application of automation and AI. Waystar, the provider of Baylor Scott & White’s estimate tool, automates the process of checking claims statuses with insurance companies’ accounts payable departments to see whether reimbursements have been made — a process previously done via phone. It seems likely that “Have your AI call my AI” will become a common refrain.

.png)

.png?width=906&height=553&name=Untitled%20(940%20%C3%97%20574%20px).png)

-1.png?width=1148&name=CDaaS%20-%20Generic(1)-1.png)

.png?width=247&name=Untitled%20design%20(1).png)

(1).png?width=837&height=702&name=Integration%20graphic%20(940%20%C3%97%20788%20px)(1).png)